In today’s fast-paced world, finding reliable financial solutions is crucial. Whether you’re paying bills, sending money to a loved one, or making a purchase, money orders can be a safe and convenient option. This article will explore everything you need to know about finding “money orders near me,” ensuring you have all the information you need at your fingertips.

Key Takeaways

- Money orders are a secure way to send or receive money without a bank account.

- They can be purchased at various locations, including post offices, banks, and retail stores.

- It’s essential to compare fees and limits before choosing a provider.

- Understanding the process and requirements can save time and ensure a smooth transaction.

Understanding Money Orders

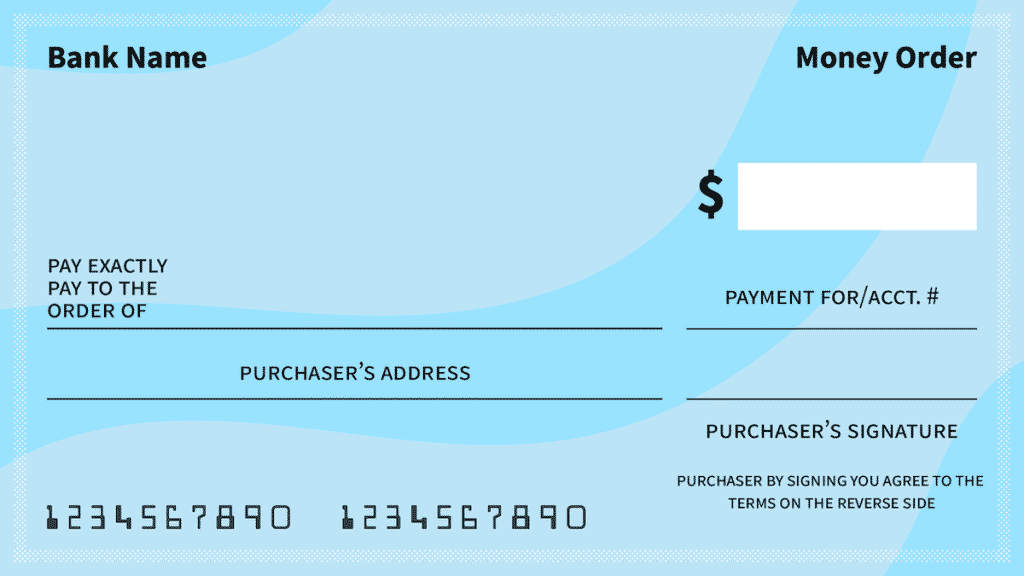

Money orders are prepaid financial instruments that function similarly to checks. They are widely accepted and offer a secure method of payment. Unlike personal checks, money orders do not bounce because they are prepaid, making them a preferred choice for many people.

Why Choose Money Orders?

There are several reasons why someone might opt for a money order over other forms of payment:

- Security: Money orders do not contain personal bank account information, reducing the risk of identity theft.

- Accessibility: They are available to individuals without bank accounts.

- Traceability: Money orders can be tracked, providing proof of payment.

- International Use: Some money orders can be used internationally, making them ideal for sending money abroad.

Where to Find Money Orders Near Me

Finding money orders near you is easier than you might think. Here are some common places where you can purchase money orders:

Post Offices

The United States Postal Service (USPS) is one of the most reliable places to purchase money orders. They offer domestic and international money orders, making them a versatile option. USPS money orders are also affordable, with fees typically lower than other providers.

Banks and Credit Unions

Many banks and credit unions offer money orders to their customers. While fees may vary, account holders often enjoy reduced rates. It’s advisable to check with your bank regarding their specific fees and limits.

Retail Stores

Large retail chains such as Walmart, CVS, and 7-Eleven provide money order services. These locations often have extended hours, making them a convenient option for those with busy schedules. However, fees and limits can vary, so it’s wise to compare options.

Check-Cashing Stores

Check-cashing stores are another option for purchasing money orders. These establishments often cater to individuals without bank accounts and may offer additional services like bill payment and money transfers. Be aware that fees at check-cashing stores might be higher than other locations.

Factors to Consider When Choosing a Money Order Provider

Before purchasing a money order, consider the following factors to ensure you make the best choice:

- Fees: Compare the cost of purchasing a money order at different locations. Some providers offer lower fees, especially for regular customers.

- Limits: Money orders have maximum limits, often ranging from $500 to $1,000. Determine if the limit meets your needs.

- Availability: Consider the hours of operation and accessibility of the provider. Retail stores often have longer hours than banks.

- Customer Service: Choose a location known for good customer service to ensure a smooth transaction.

How to Purchase a Money Order

Purchasing a money order is a straightforward process. Follow these steps for a hassle-free experience:

- Identify the Amount: Determine the exact amount you need for the money order, including any associated fees.

- Choose a Provider: Select a convenient location based on fees, limits, and hours of operation.

- Prepare Payment: Money orders are typically paid for with cash, debit card, or traveler’s checks. Be prepared to pay the total amount upfront.

- Fill Out the Money Order: Complete the money order with the recipient’s name and your details. Keep the receipt for tracking purposes.

- Deliver the Money Order: Send or deliver the money order to the recipient. Ensure they know it’s coming for a smooth transaction.

Tracking and Canceling Money Orders

One of the advantages of money orders is their traceability. If you need to track or cancel a money order, follow these steps:

Tracking

Most providers offer tracking services for money orders. Use the receipt or tracking number to check the status online or by contacting customer service.

Canceling

If you need to cancel a money order, contact the provider as soon as possible. There may be a cancellation fee, and you will need to provide proof of purchase, such as the receipt or tracking number.

Finding “money orders near me” doesn’t have to be a daunting task. By understanding the types of providers available and considering factors such as fees, limits, and convenience, you can choose the best option for your needs. Whether you’re sending money to a family member or paying a bill, money orders offer a secure and reliable solution.

By following this guide, you can confidently navigate the world of money orders, ensuring your transactions are smooth and efficient. Remember to keep your receipt and track your money order for added security. With these tips in mind, you’ll be well-equipped to handle your financial needs with ease.